The National Tax and Customs Directorate (DIAN) declared a contingency due to the unavailability of electronic IT services caused by technical incidents in the information systems, through press release number 047 issued on May 13, 2025.

By virtue of Article 70 of Resolution 162 of October 31, 2023, in the event of a contingency, the reporting party may fulfill the corresponding legal obligation within eight (8) business days following the end of the deadlines established for submitting the respective information, without this being considered late. In any case, the reporting party may submit the information earlier if they wish.

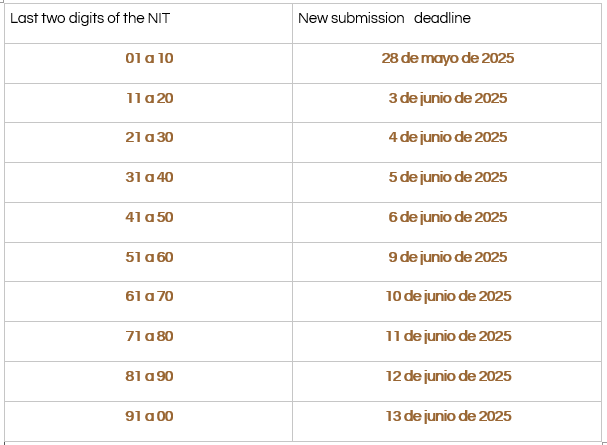

Resolution 213 of May 23, 2025, extends the deadlines for the submission of Exogenous Information for:

-

- Large taxpayers whose Tax Identification Numbers (TIN) end in 9 and 0, with original deadlines scheduled for May 12 and 13, are now extended until May 28, 2025.

-

- Legal entities and individuals as follows:

It is worth mentioning some of the individuals who are required to provide tax information for the 2024 tax year under Resolution No. 162 of October 31, 2023:

-

- Those who, during the tax year to be reported or the immediately preceding tax year, earned gross income exceeding 11,800 Tax Value Units (UVT) (equivalent to \$555,367,000), provided that, in addition, gross income from capital gains and/or non-labor income exceeds 2,400 UVT (\$112,956,000).

-

- Individual taxpayers under the Simple Taxation Regime (SIMPLE) who, during 2024 or 2023, earned gross income exceeding 11,800 UVT (\$555,367,000), regardless of the type of income.

For the purposes of determining the reporting obligation of the individuals mentioned in the two preceding paragraphs, 'Gross Income' includes all ordinary and extraordinary income, as well as income from occasional gains, except for that derived from the sale of a primary residence (house and/or apartment).

-

- Individuals required to withhold and self-withhold at the source for income tax, value-added tax (VAT), and/or stamp tax during the tax year to be reported.

-

- Individuals or entities that enter into collaboration agreements such as consortia, temporary unions, joint ventures, partnership accounts, or cooperation agreements with public entities, as well as those who enter into other contracts such as mandates, delegated administration, or exploration and exploitation of hydrocarbons, gases, and minerals.

-

- Individuals or entities that issue sales invoices or equivalent documents.

In compliance with personal data regulations, REYES ABOGADOS ASOCIADOS S.A. invites you to contact us if you do not wish to receive our legal updates. This bulletin is provided by REYES ABOGADOS ASOCIADOS S.A. for informational purposes only. It does not constitute legal advice or guidance. For specific cases, we recommend consulting legal professionals before making decisions based on the information contained herein.